How it works

TokenWhisperer is the brainchild of the Eunice research team, who grew tired of seeing promising narratives become hunting grounds for sophisticated grifters exploiting innocent retail traders. So using our data, we built a tool to help level the playing field.

We want to equip all market participants to navigate the three stages of a trader’s life cycle – discovery, due diligence, and profit-taking – with a curated data set for each stage.

Get to know Token Whisperer:

Part One: Our Metrics

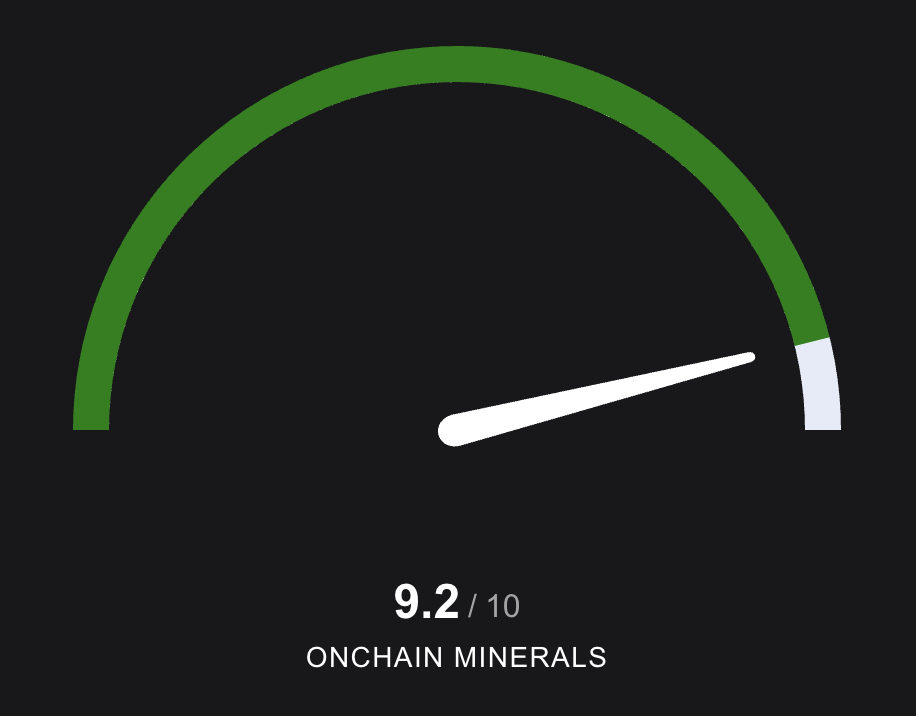

Onchain Minerals Score

We have created a category benchmark called Onchain Minerals which introduces a new standard to analyse memecoins to minimise risks. We did this by selecting a basket of 37 meme coins, and see the table below for the full list of coins in this benchmark.

View full list of coins in this benchmark

- We identified the following five on-chain metrics as essential: Large Holders, Fresh Addresses, Volume / Market Cap, Holding Time Ratio, and Decentralisation Ratio - they are explained below:

Large Holders (⬆️ Higher, the Better ✅)

- This measures the number and % of holders with balances > $1k.

- Why: Higher meaningful holdings indicate greater conviction and can be a signal to show what smart money believes in most.

Fresh Addresses (⬇️ Lower, the Better ✅)

- This measures in the first 7 days of the token inception, the % of tokens bought by addresses that haven't done more than 5 swaps before

- Why: Tokens with a high % indicate a greater likelihood that fresh wallets are being created to distribute large chunks of supply to potentially dump on buyers.

Volume / Market Cap (Between 0.5% to 100%, the Better ✅)

- This measures the DEX trading volume relative to the token's total market value over the last 24-hour period.

- Why: Volume = Attention. A single uptick or high Vol/MC ratio can signal the start of a trend. A consistent and growing ratio indicates high attention, and beginning to de-risk as it approaches 100% could be prudent. Values over 100%, especially anomalous, may indicate wash trading. Conversely, a very low ratio (e.g., 0 to 0.5%) suggests minimal trading, possibly indicating the coin is "dead."

Holding Time Ratio (⬆️ Higher, the Better ✅)

- This measures the average duration a token remains in a wallet relative to its total existence in time.

- Why: A high ratio indicates high conviction and genuine long-term holders (a.k.a. diamond hands). Tokens with lower ratios are often characterized by rapid distribution patterns typical of insider trading. This metric is most useful when comparing tokens of similar deployment age.

Decentralization Ratio (⬆️ Higher, the Better ✅)

- This measures the decentralization of token ownership by calculating the inverse of the centralization ratio. The centralization ratio is derived from the Herfindahl-Hirschman Index (HHI) score, normalized by dividing by 10,000. The decentralization ratio is calculated as: (1 - HHI score/10k).

- Why: Calculating the decentralization ratio provides insights into how evenly ownership is distributed across holders of a given token.

Part Two: Our Data

How do you ensure the quality of data?

- Validation: Ensuring accuracy and consistency by cross-referencing multiple sources such as Block Explorers and Holder Scans. We also partner with trustworthy data providers such as Allium.

- Cleaning: Eliminating duplicates, resolving discrepancies, and standardising transaction records to maintain data integrity.

- Monitoring: We do our best to identify, track, and swiftly address issues to maintain the highest standards of data quality. If you spot anything, please shout out in our Telegram group and we will address it.

How often is data updated?

- On data latency: Data on our application is refreshed every six hours and we are working on reducing latency.

- On coverage: Token requests are reviewed a minimum of once per week. However, we understand the constant rotation of money in the industry and aim to review requests 3 times per week.

Part Three: FAQs

How are tokens added?

- Tokens are curated by both the community and Eunice's research team. We would like the requested tokens to meet the minimum criteria below, however, the final decision on which tokens to add will lie with our research team.

- We kindly ask that you avoid excessive promotion or repeated requests regarding specific tokens. Such behavior may have the opposite effect.

- Criteria:

- Tokens aged < 3d

- Liquidity/market cap ratio > 0.05

- Volume/market cap ratio (3-day average - ideally if we store the data for each day rather than taking 3-day volume and dividing by current day market cap) > 0.33

- Tokens aged > 3d

- Liquidity/market cap ratio > 0.05

- Volume/market cap ratio > 0.1

What chains does it cover?

- Our data covers Ethereum and Solana at the moment. We are in the process of expanding our coverage to more chains such as Base.

How can I request tokens, metrics or provide general feedback?

- We love feedback. And we love hearing your suggestions for metrics and features you'd like to see! Please share your ideas in our Telegram group or through the feedback form in our application.

Some tokens in the Token Whisperer look like scams, why have these been added in?

- We included some scam tokens in the Token Whisperer: MONAI, INTRO, and SCRAT. These tokens were selected because their teams exploited investors as exit liquidity, providing examples of how rug pulls operate.